In this article, we are going to decompose the different features of the GMX protocol and see why, with all its assembled utilities, it could be an ideal candidate to represent the lung of DeFi.

Before starting, I prefer to advise that we are not going to review the basic fundamentals of GMX since there are already tons of brilliant threads about it that I recommend beginners to read before this piece.

Price Backed by real earnings

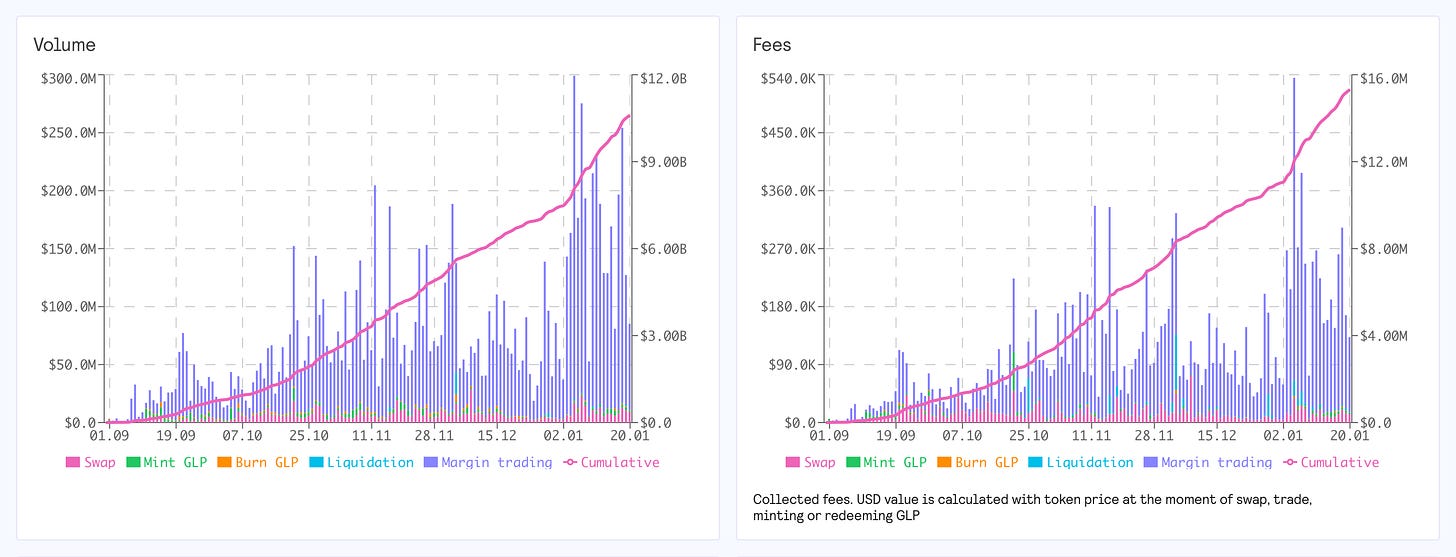

Thanks to $GLP's ultra capital efficient system, the fees generated by the DEX are honestly phenomenal. At the time of Gambit, the protocol was facilitating 30% of the aggregators swaps volume on the Binance Smart Chain (around $30M daily) with only $1.5M of liquidity.

Now the exchange is doing $250M daily volume without big aggregators integrations yet.

The token earns 30% of the fees generated on all blockchains. Last time I calculated, $GMX collected $11.4m annualized fees on Avalanche and $13.7m on Arbitrum for a total of $25.1m.

The correct way to look at it, is :

$25m fees annualized = 10% interest at $250m Marketcap = 34$/GMX

It works a bit like a bond in traditional finance, the fees are predictable and distributed weekly. And the very lucrative thing with $GMX is that it hasn’t even reached 2% of the TAM in swaps and derivatives markets.

The size of the fees + the size of the TAM are the two singularities that differentiate GMX from the rest of the market and makes it stand out. Because of the earnings, it’s easy to establish price bands on the price of $GMX and it facilitates the adoption of options and market-making on the token.

GLP a Treasury-Grade Asset :

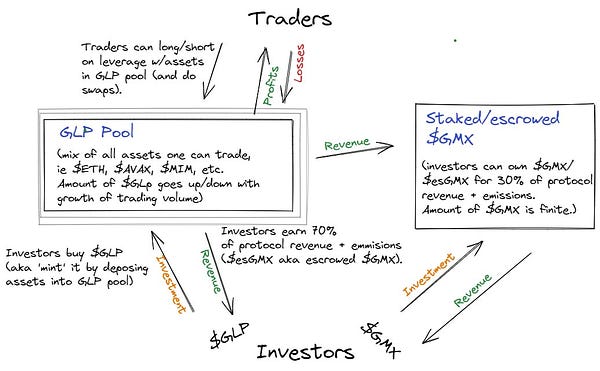

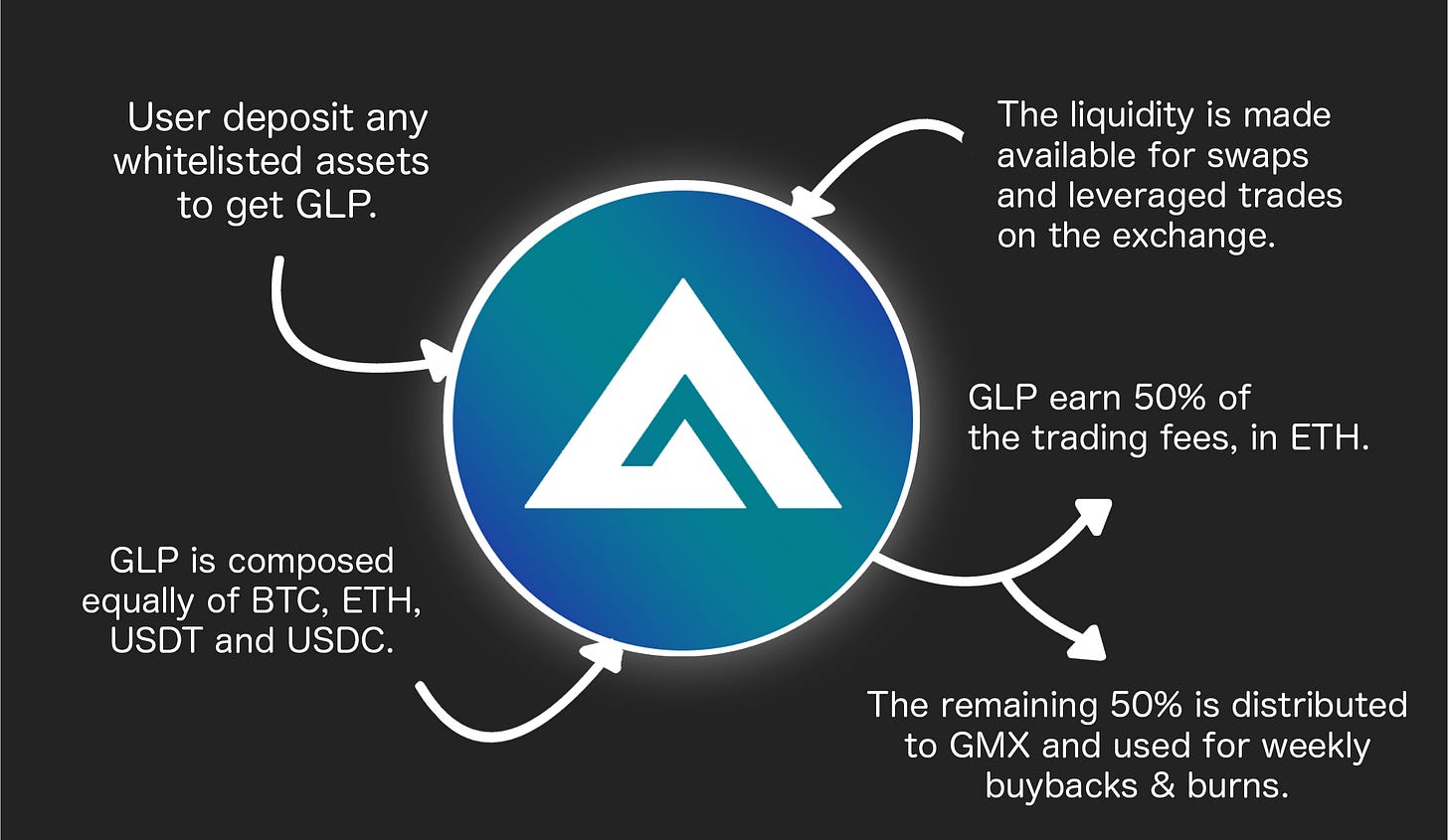

GLP is an Index composed of crypto majors and 50% stablecoins. Here’s an old infographic that explains how it works :

GLP brings in so much volume and fees that it can be called a cash cow, liquidity providers have been earning 50% + paid in $ETH on their deposits for months.

Since the launch of GLP in September the price has risen from $1.19 to $1.28 (including fees) while BTC is down -40% from ATH and the market is in full bear.

This incredible resilience makes it a qualitative asset for any DeFi protocol treasury, projects adopting GLP are accumulating esGMX, thus governance power + dividends in ETH.

Many protocols are already using GLP & GMX as a yield-generative treasury. The main one is the Blueberry Club, an NFT Collection dedicated to the GMX Ecosystem, with liquidity of nearly $1,000,000 diversified in GMX assets through Arbitrum & AVAX.

There are also DAOJones, Umami, RoyalRabbit, and soon ROOK using GLP for all the advantages it offers. This trend will simply continue as long as GLP remains so profitable.

Market-Making :

One could say that GMX is predictably a 100x away from reaching its potential. Because of this, market-making on the token makes sense for investors looking to out-perform ETH.

This can not be tried for the moment because there’s actually no V3 vault on Arbitrum, but I think that once projects like Popsicle and Charm come on L2s, we could see 100%+ APR on GMX/ETH pairs paid only from LP fees.

Cross-Chain Liquidity :

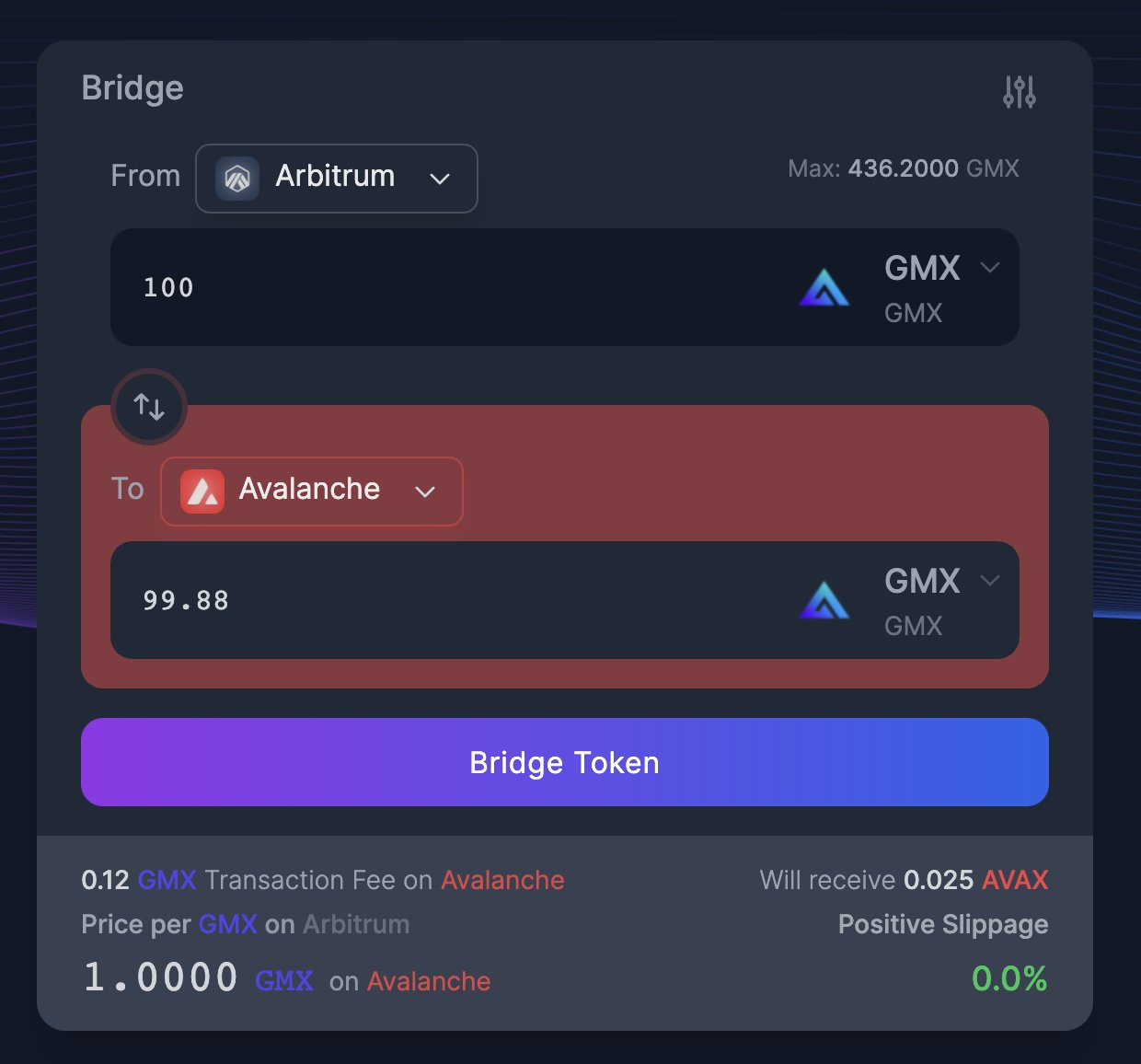

GMX will continue to deploy on every L1s that have gained consistent traction and there will be GMX liquidity on all chains. Thanks to the partnership with Synapse, the token can be bridged between any blockchain in few seconds.

This means that fast arbitrage opportunities between chains are possible and will boost the overall volume on $GMX.

Single Staking Partnerships :

The collaboration with Dopex unlocks a new utility on $GMX, option trading.

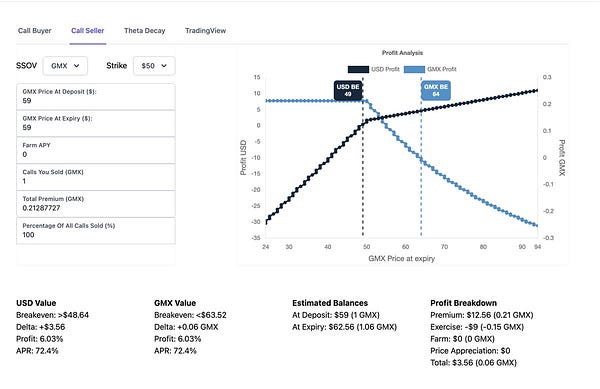

The GMX SSOV was a great success with TVL at almost $1M. And thanks to @revofusion for the SSOV calculator

But there is a special feature with $GMX that makes things more interesting.

The $GMX deposited in Dopex SSOV are also staked to earn platform fees in $ETH & esGMX.

The ETH from staking is distributed to SSOV's depositors but esGMX is not transferable and therefore go back to Dopex. With $900K TVL on this epoch, Dopex is accumulating $15,000 in esGMX and SSOV's depositors collect all the option premiums.

This is a win-win solution: Dopex gives more utility to $GMX, and accumulates governance power in proportion to SSOV usage. There is also DAOJones who intends to make a vault of Hedged options strategies that will allow them the same solution as Dopex.

The uniqueness of having esGMX non-transferable is an incentive for projects to build usage on $GMX and accumulate governance power + ETH fees.

Supply-Crunch :

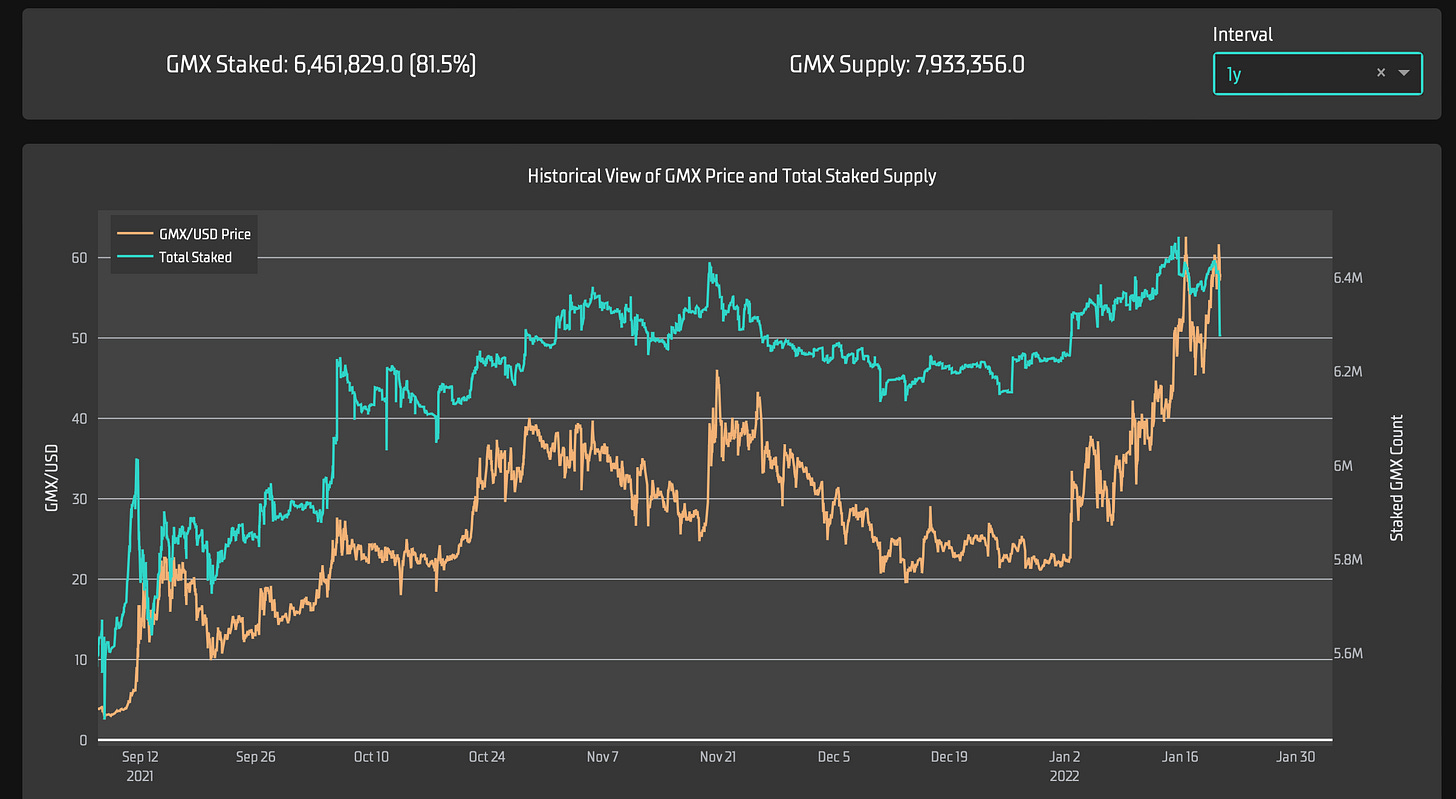

Typically, between 80 and 90% of the $GMX circulating supply is in staking to receive the platform fee.

The more $GMX is used in other vaults (Uniswap V3, options, CEX listings...) the more the ETH APR in the staking will increase and therefore the price will have to rise to match the new meta.

Repeated simply, the more projects create usage on GMX to accumulate it, the higher the price will go because of the token mechanics.

Perpetual Contracts :

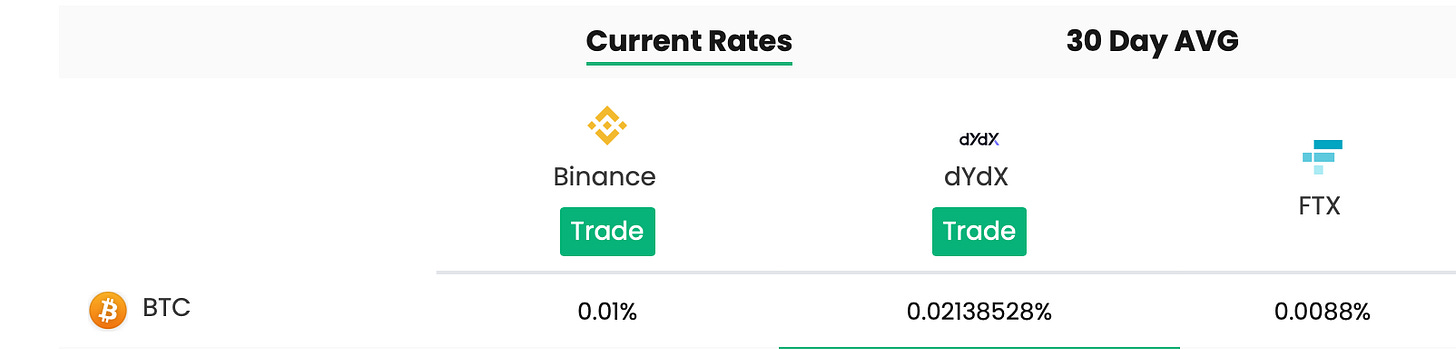

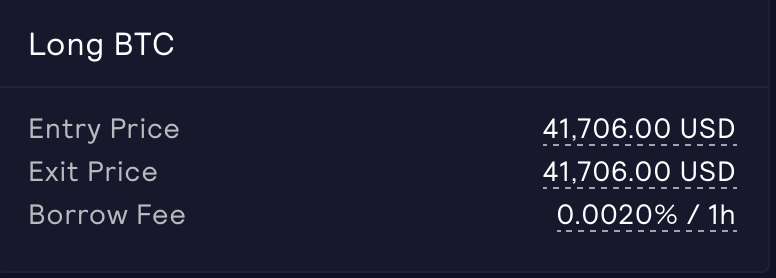

Funding fees on GMX perps are often way under dYdX and moreover, GMX provides higher leverage (30x vs 10x) and its smart-contracts are DeFi compatible.

This primitive allows protocols to create things such as basis trading on top of GMX, for example, Lemma proposes exactly that with their yield-bearing stablecoin $USDL. It’s only available on MCDEX for now but they have plans to expand the list of DEXes.

Other solutions similar to the basis trading but with options (I’m not an expert) are being explored by Premia, the composability of GMX is a big selling point.

Conclusion

GMX is a multi-chain protocol for perpetuals and swaps, 100% fee sharing, and fully compatible with DeFi. All its singularities, transparency and the infinite number of use-cases it offers, makes it an ideal token to trade for representing the global health of the crypto market.

This is the end of my article thank you for reading until the end. 🙏🏽💙🫐

dYdX has no fees now